food tax in massachusetts calculator

Food sold by a business that is primarily engaged in the business of selling meals is taxable at the Massachusetts meals tax rates. In 2022 and possibly in 2023 any taxpayer who generates income in Massachusetts will be charged with a 5 state income tax.

States With The Highest And Lowest Sales Taxes

Massachusetts State Sales Tax.

. Also check the sales tax rates in different states of the US. After a few seconds you will be provided with a full. Massachusetts is a flat tax state that charges a tax rate of 500.

This takes into account the rates on the state level county level city level and special level. Massachusetts has a 625 statewide sales tax rate. Massachusetts officials announced last week that 3 billion in surplus tax revenue will be returned to taxpayers.

Just enter the wages tax withholdings and other information. Your average tax rate is 1198 and your. That goes for both earned income wages salary commissions and unearned income.

625 of the sales price of the meal. Go to the Massachusetts Online SNAP Calculator. This income tax calculator can help estimate your average.

The tax is 625 of the sales price of. Local tax rates in Massachusetts range from 625 making the sales tax range in Massachusetts 625. While Massachusetts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes.

During the COVID-19 pandemic health emergency all households eligible for a SNAP benefit receive at least the maximum. This calculator is detailed and is designed for advocates or others familiar with Excel and the SNAP rules. Massachusetts Income Tax Calculator 2021.

The state income tax rate in Massachusetts is 5 while federal income tax rates range from 10 to 37 depending on your income. Maximum Possible Sales Tax. The most significant taxes in Massachusetts are the sales and income taxes both of which consist of a flat rate paid by residents statewide.

15-20 depending on the distance total price etc. Use ADPs Massachusetts Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. Average Local State Sales Tax.

Maximum Local Sales Tax. Massachusetts imposes a sales tax on meals sold by or bought from restaurants or any restaurant part of a store. If you make 70000 a year living in the region of Massachusetts USA you will be taxed 11667.

However depending on how much you make in a year you. These businesses include restaurants cafes. The Massachusetts income tax rate.

The Federal or IRS Taxes Are Listed. Massachusetts charges a sales tax on meals sold by restaurants or any part of a store considered by Massachusetts law to be a restaurant. Estimate Your Federal and Massachusetts Taxes.

54 rows Free calculator to find the sales tax amountrate before tax price and after-tax price. The Massachusetts Income Tax Calculator Will Let You Calculate Your State Taxes For the Tax Year. This page describes the taxability of.

The base state sales tax rate in Massachusetts is 625. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. And all states differ in their.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. The average cumulative sales tax rate in the state of Massachusetts is 625. Overview of Massachusetts Taxes.

State Auditor Suzanne Bump announced Thursday that she had. The meals tax rate is 625.

Here S How Much Money You Take Home From A 75 000 Salary

New York City Sales Tax Rate And Calculator 2021 Wise

Freelance Target Income Calculator By Paul Millerd Reimagine Work Medium

States With The Highest And Lowest Sales Taxes

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Massachusetts Sales Tax Calculator And Economy 2022 Investomatica

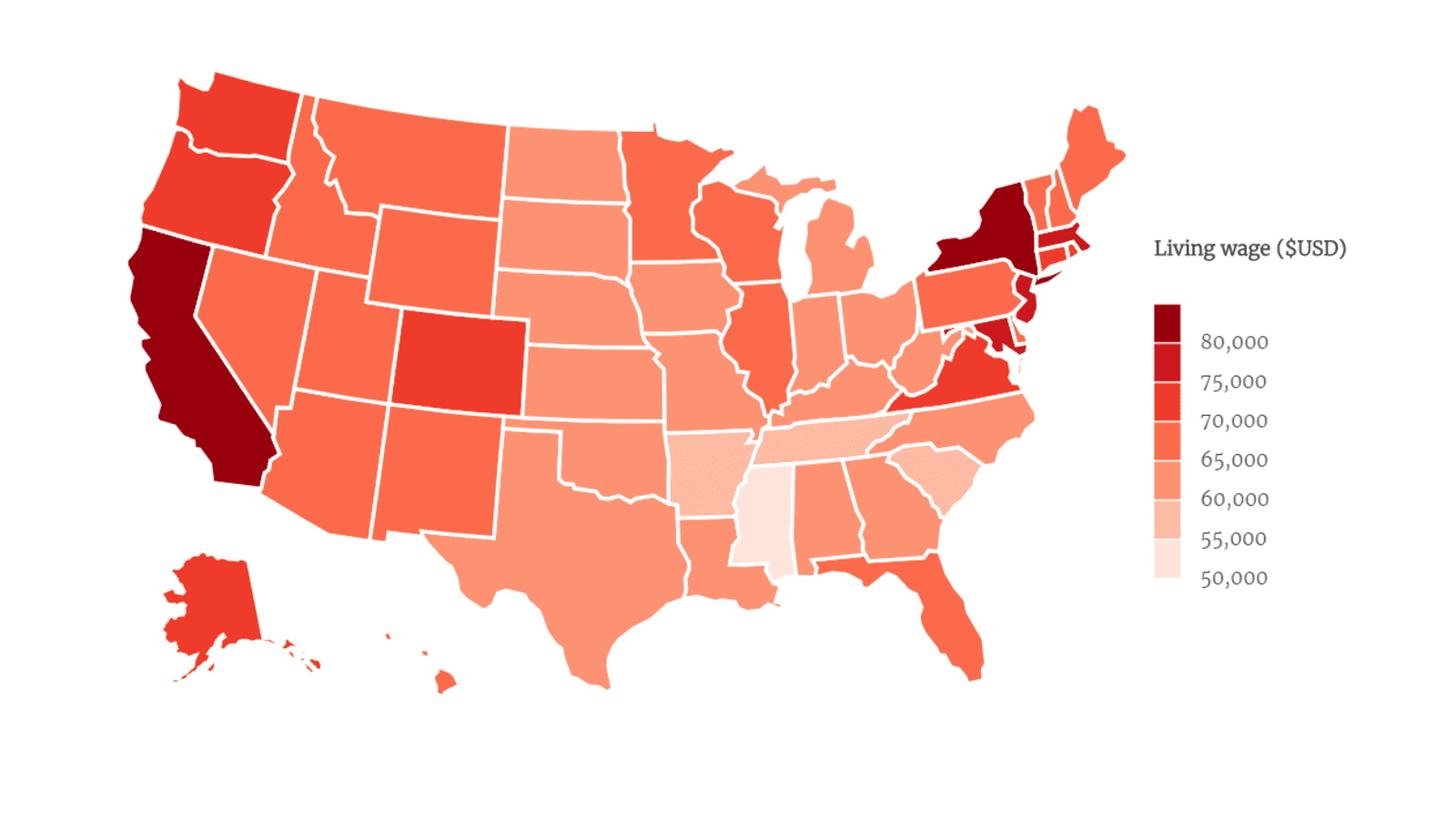

How Much Money A Family Of 4 Needs To Get By In Every Us State

4 Ways To Calculate Sales Tax Wikihow

Massachusetts Paycheck Calculator Smartasset

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Tax Deductions For Gluten Free Food National Celiac Association

New York Sales Tax Everything You Need To Know Smartasset

Massachusetts Sales Tax Calculator And Economy 2022 Investomatica

13 States With Back To School Sales Tax Holidays In August Money

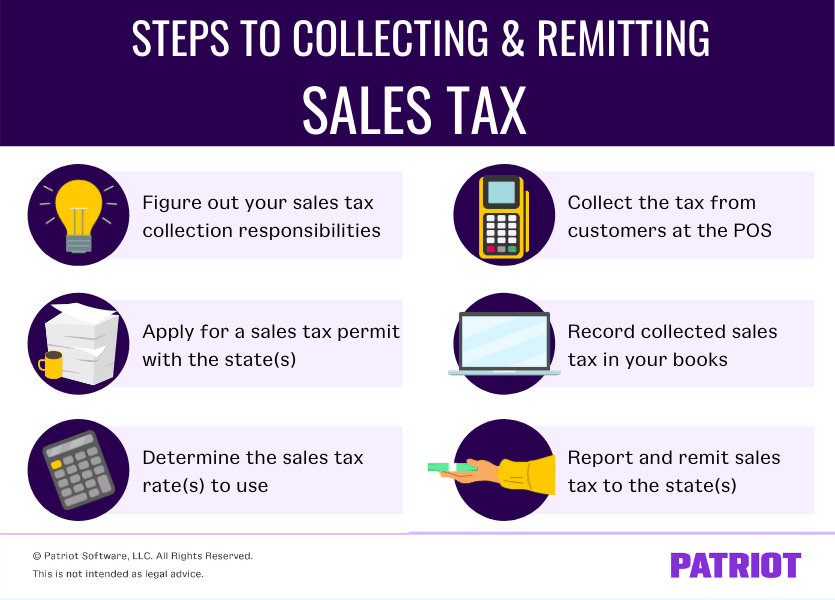

How To Pay Sales Tax For Small Business 6 Step Guide Chart

How To Charge Your Customers The Correct Sales Tax Rates

How To Calculate Sales Tax And Avoid Audits Article

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking